The debt-to-equity ratio is a financial metric used to measure a company’s leverage by comparing its total debt to its shareholders’ equity. It indicates the proportion of financing provided by creditors relative to that provided by shareholders.

What does the debt-to-equity ratio tell you about a company?

Leverage Level: The debt-to-equity ratio provides insight into the level of leverage or financial risk assumed by a company. A higher ratio indicates that the company relies more heavily on debt financing, which can increase financial risk but also potentially enhance returns.

Financial Stability: A low debt-to-equity ratio may suggest greater financial stability, as the company has less debt to repay and may be better positioned to weather economic downturns or financial challenges.

Capital Structure: The ratio also reflects the company’s capital structure and financing decisions, influencing its ability to raise capital and allocate resources effectively.

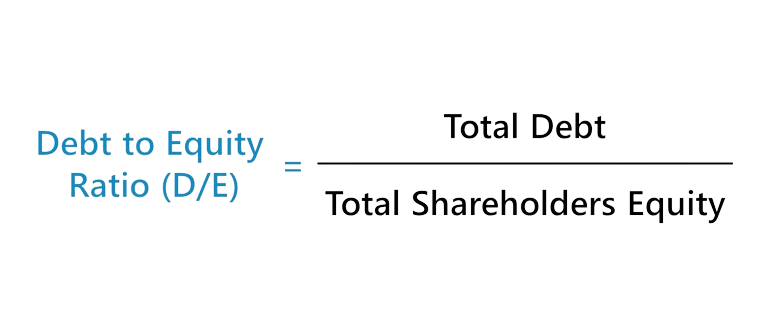

How is it calculated?

The debt-to-equity ratio is calculated by dividing the total debt of a company by its total shareholders’ equity. The formula is as follows:

How do investors interpret the debt-to-equity ratio?

- Risk Assessment: Investors use the debt-to-equity ratio to assess the level of financial risk associated with investing in a company. A higher ratio may indicate higher risk, as the company has more debt obligations to meet.

- Comparative Analysis: Investors compare the debt-to-equity ratios of different companies within the same industry to evaluate relative risk levels and financial health.

- Investment Decision-making: The ratio influences investment decisions, with some investors preferring companies with lower debt-to-equity ratios as they may be perceived as less risky investments.

What is the high vs a low debt-to-equity ratio for a company?

High Debt-to-Equity Ratio: A high debt-to-equity ratio typically indicates that a company relies heavily on debt financing to fund its operations and growth. While this can amplify returns during periods of growth, it also increases financial risk, as the company may struggle to meet its debt obligations, especially in challenging economic conditions.

Low Debt-to-Equity Ratio: Conversely, a low debt-to-equity ratio suggests that a company relies more on equity financing than debt. This may signal greater financial stability and flexibility, as the company has fewer debt obligations to manage. However, excessively low ratios may indicate underutilization of debt financing and potential missed opportunities for growth.

Conclusion

Debt-to-equity ratio is a vital financial metric that provides valuable insights into a company’s leverage, financial stability, and capital structure. By analysing this ratio, investors can assess the risk profile of a company and make informed investment decisions aligned with their risk tolerance and investment objectives.