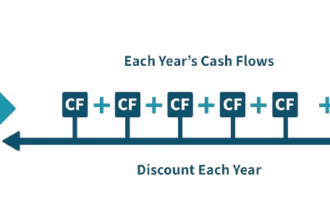

Discounted Cash Flow (DCF) analysis is a method used to evaluate the value of an investment based on its expected future cash flows. It calculates the present value of all future cash inflows and outflows associated with an investment, taking into account the time value of money.

What are the key components of a DCF analysis?

- Cash Flows: The projected cash flows generated by the investment over a specific time horizon serve as the foundation of DCF analysis.

- Discount Rate: The discount rate, often represented by the weighted average cost of capital (WACC) or the investor’s required rate of return, is used to discount future cash flows to their present value.

- Terminal Value: DCF analysis typically incorporates a terminal value, representing the value of the investment beyond the explicit forecast period. This is often estimated using a perpetuity growth model or an exit multiple approach.

How is the discount rate determined in a DCF analysis?

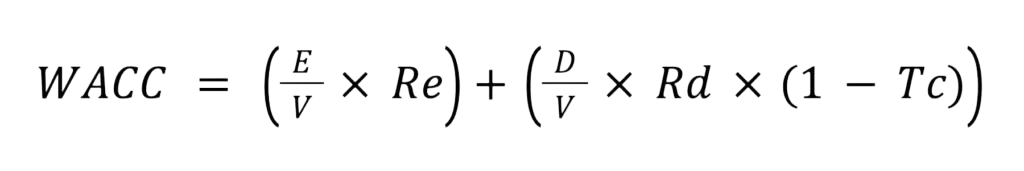

1.Weighted Average Cost of Capital (WACC): The WACC reflects the weighted average of the cost of equity and the cost of debt, weighted by their respective proportions in the capital structure.

where

V = D + E

E => Market value of Equity

D => Market value of debt

Re => Cost of equity

Rd => Cost of debt

Tc => Corporate tax rate

2. Risk-adjusted Rate of Return: The discount rate may be adjusted based on the perceived risk associated with the investment, incorporating factors such as market risk, industry risk, and company-specific risk.

Radjusted = Rrisk-free + β x (Rmarket – Rrisk-free)

where

Radjusted is the risk-adjusted rate of return.

Rrisk-free is the risk-free rate of return representing the return on a risk-free investment such as a Treasury bond.

𝛽 is the beta coefficient which measures the sensitivity of the investment’s returns to market movements.

Rmarket is the expected return on the overall market.

What are the applications of DCF analysis?

Valuation of Investments: DCF analysis is commonly used to assess the value of stocks, bonds, real estate properties, and other investment opportunities.

Capital Budgeting: Businesses utilize DCF analysis to evaluate potential capital expenditures and investment projects, helping to prioritize projects based on their expected returns.

Mergers and Acquisitions: DCF analysis plays a crucial role in determining the value of target companies during mergers and acquisitions, guiding negotiations and decision-making processes.

What are the advantages and limitations of using DCF?

- Advantages:

- Flexibility: DCF analysis can accommodate various types of cash flow projections and investment scenarios, making it adaptable to different situations.

- Focus on Cash Flows: By focusing on cash flows rather than accounting profits, DCF analysis provides a more accurate representation of an investment’s value.

- Limitations:

- Sensitivity to Assumptions: DCF analysis is highly sensitive to the accuracy of input assumptions, including cash flow projections, discount rates, and terminal value estimates.

- Subjectivity: The selection of discount rates and growth assumptions involves subjective judgment, leading to potential bias and uncertainty in the valuation results. Additionally, DCF analysis may not fully capture qualitative factors that can impact investment value.

Conclusion

Discounted Cash Flow (DCF) analysis is a powerful tool used in finance to evaluate the value of investments based on their expected future cash flows. While it offers flexibility and a focus on cash flows, DCF analysis requires careful consideration of input assumptions and may be subject to subjective judgment and limitations.