Research By: Tushar Nischal

Bonds

A bond is a financial instrument representing a loan from an investor to an issuer, such as a corporation or government. When an investor buys a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds have a fixed interest rate, known as the coupon rate, and a set maturity date when the principal is repaid. They are often used by entities to raise capital and provide investors with a predictable income stream, typically making them a lower-risk investment compared to stocks.

Convertible Bonds

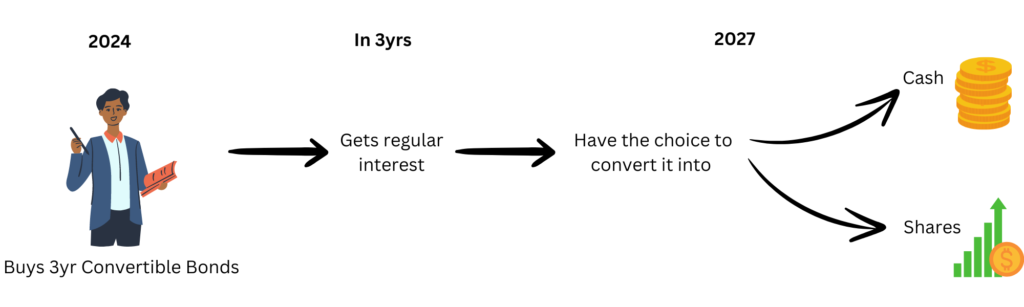

Convertible bonds offer a fascinating mix of features, combining the stability of traditional bonds with the exciting potential of stocks. They are corporate debt securities that not only pay regular interest but also give investors the option to convert their bonds into shares of the company’s stock. This hybrid nature makes convertible bonds an appealing choice for many investors.

How Convertible Bonds Work

Convertible bonds provide investors with flexibility. They can choose to convert their bonds into shares at the predetermined conversion price or hold the bond until maturity to receive interest payments and the principal amount. The conversion ratio specifies how many shares are received per bond, offering a potential reward if the company’s stock price increases.

Convertible bonds blend the best of both worlds—offering the safety of fixed interest payments and the potential for equity upside. While they come with their own set of advantages and challenges, they can be a valuable addition to an investment portfolio.

What Makes Convertible Bonds Unique?

1. The Conversion Option

The standout feature of convertible bonds is the conversion option. This allows bondholders to swap their bonds for a predetermined number of shares in the issuing company. For instance, if a bondholder has a bond with a conversion ratio of 20:1, they can convert one bond into 20 shares of the company’s stock. This feature becomes particularly valuable if the company’s stock price increases significantly, offering investors a chance to profit from the rise in share value.

2. Regular Interest Payments

Convertible bonds pay interest just like other bonds. However, because they offer the potential for conversion into equity, their coupon rates are often lower than those of non-convertible bonds. For example, while a traditional bond might offer a 6% annual interest rate, a convertible bond might offer only 4%. This trade-off is the price investors pay for the opportunity to convert their bonds into shares.

3. Maturity Date

Like traditional bonds, convertible bonds have a fixed maturity date. This is the date when the issuer must repay the bond’s face value if the bondholder has not chosen to convert it into stock. If the bondholder decides not to convert, they will receive their initial investment back at maturity. Convertible bonds typically have maturity periods ranging from 5 to 10 years.

4. Conversion Ratio and Price

The conversion ratio is a key aspect of convertible bonds. It determines how many shares a bondholder will receive upon conversion. For example, a ratio of 20:1 means that each bond can be converted into 20 shares of stock. The conversion price is the price per share at which the conversion happens. It’s usually set above the current market price of the stock to encourage investors to convert only when the stock price rises.

5. Additional Features: Call and Put Options

Convertible bonds can also come with call and put options:

- Call Option: This feature allows the issuer to redeem the bond before its maturity date, often at a premium. This is useful for issuers if interest rates fall or if they want to encourage conversion when the stock price is high.

- Put Option: This gives bondholders the right to sell the bond back to the issuer at a specified price before maturity. It provides investors with a safety net if they need liquidity or if they foresee a decline in the stock price.

Different Types of Convertible Bonds

1. Vanilla Convertible Bonds

These are the most straightforward type. Bondholders can either hold the bond until maturity or convert it into stock. If the stock price falls, they can retain the bond and get its face value back. Conversely, if the stock price rises, they can convert the bond into shares and potentially benefit from the increase in value.

2. Mandatory Convertible Bonds

These bonds require conversion into equity at a specific ratio and price level. They help companies manage their capital structure by ensuring that debt is converted into equity.

3. Reversible Convertible Bonds

Reversible convertible bonds offer flexibility to the issuer. The company can choose to convert the bond into equity or keep it as a fixed-income investment. This option is beneficial for the issuer based on their financial strategy and market conditions.

Pros and Cons of Convertible Bonds

1. Benefits for Companies

- Mitigating Negative Sentiment: Issuing convertible bonds helps companies avoid the negative perception that often accompanies issuing new equity, as the conversion is optional and based on the company’s performance.

- Lower Interest Costs: Companies can often secure lower interest rates with convertible bonds compared to traditional bonds due to the added value of the conversion option.

2. Benefits for Investors

- Downside Protection: Convertible bonds offer protection on the downside. If the company struggles, bondholders will receive the bond’s face value at maturity, providing a safety net.

- Upside Potential: If the company’s stock price performs well, investors can convert their bonds into shares and benefit from the appreciation, potentially earning substantial gains.

3. Drawbacks

- Lower Coupon Rates: Convertible bonds typically offer lower interest rates compared to non-convertible bonds, reflecting the value of the conversion feature.

- Increased Volatility: Convertible bonds can be more volatile than traditional bonds because their value is tied to the stock price of the issuing company.

Tax Implications

1. Interest Income

Interest payments from convertible bonds are generally taxed as ordinary income in the year they are received. This is like how traditional bond interest is taxed.

2. Capital Gains

If a convertible bond is converted into shares and those shares are sold, any gains or losses from the sale are subject to capital gains tax. While the conversion itself is not taxable, the subsequent sale of the shares is.

3. Original Issue Discount (OID)

Convertible bonds issued at a discount may have OID, which is taxable as ordinary income over the bond’s life. This is the case regardless of whether the bond is held to maturity or sold before then.

4. Dividends

If shares acquired through the conversion of a convertible bond pay dividends, those dividends may qualify for lower tax rates as qualified dividends, depending on the investor’s tax situation.