Written By: Nishant Parsad

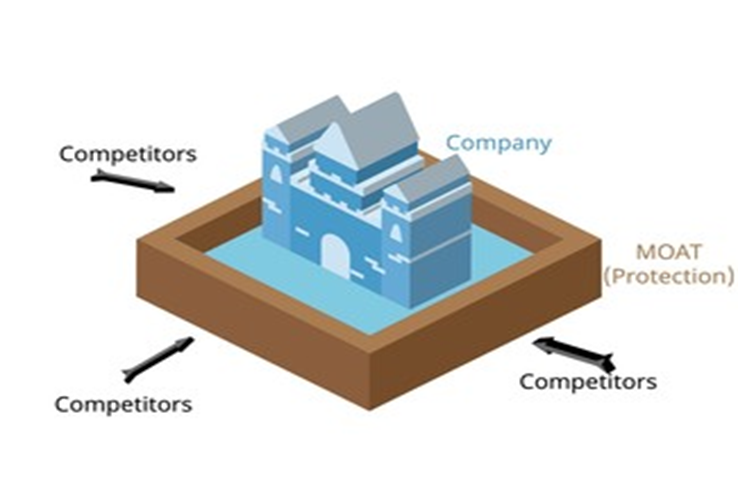

Imagine you’re building a castle. The stronger and wider your moat, the harder it is for invaders to attack. In the business world, an economic moat serves the same purpose—it protects a company from competitors and ensures long-term profitability.

Warren Buffett, one of the greatest investors of all time, often emphasizes investing in companies with strong economic moats. But what exactly is an economic moat? How do companies build and sustain them? And most importantly, how can investors use this concept to make smarter investment decisions?

In this article, we’ll dive deep into economic moats, explore real-life company examples, and understand how they create lasting value for businesses and investors alike.

What is an Economic Moat?

An economic moat is a sustainable competitive advantage that helps a company maintain its market position and profitability over a long period. Just like a castle moat protects against invaders, a business moat shields a company from competitors by making it difficult for them to replicate its success.

Companies with strong moats can:

– Defend their market share

– Generate consistent profits

– Maintain pricing power

– Outperform competitors in the long run

Famous investors like Warren Buffett and Charlie Munger have built their investing strategies around finding companies with durable economic moats. According to Buffett, “The key to investing is determining the competitive advantage of any given company and, above all, the durability of that advantage.”

Let’s now explore the different types of economic moats with real-world examples.

Types of Economic Moats (With Real-Life Examples)

Not all economic moats are created equal. Some companies build their competitive edge through branding, while others rely on cost advantages, customer loyalty, or even government regulations. Understanding these different types of moats can help investors identify businesses that have long-term profitability and market dominance.

A. Brand Moat: The Power of Consumer Loyalty

A strong brand is one of the most powerful moats a company can have. When customers trust and associate positive emotions with a brand, they are more likely to remain loyal, even if competitors offer similar or cheaper products. For instance, Cadbury dominates the chocolate market in India because of its deep emotional connection with consumers, making it the go-to brand for chocolates. Similarly, Bisleri has become synonymous with bottled water in India, and people often refer to any packaged water as “Bisleri” regardless of the actual brand. Another great example is Colgate, which holds over 50% market share in the Indian toothpaste market. A brand moat is extremely difficult for competitors to replicate, as it is built over years of trust, advertising, and customer experience. Companies with strong brand moats can command premium pricing, maintain customer loyalty, and generate steady revenue growth.

B. Cost Advantage Moat: The Power of Lower Costs

Some businesses build their moat by being the lowest-cost producer in their industry, allowing them to offer competitive prices while maintaining high profit margins. Walmart, for example, leverages its massive global scale to negotiate better deals with suppliers, keeping its costs lower than competitors. In India, DMart has mastered the cost advantage strategy by optimizing supply chain management, bulk purchasing, and maintaining an efficient store network, making it one of the most profitable retailers in the country. Companies with a cost advantage moat are better positioned to survive economic downturns because they can afford to operate with lower margins than their competitors while still remaining profitable.

C. Switching Cost Moat: Making It Hard to Leave

Companies create a switching cost moat when customers find it too expensive, inconvenient, or time-consuming to move to a competitor. A classic example is Microsoft, which dominates the software industry with products like Windows and Microsoft Office. Many businesses and individuals continue using Microsoft products because switching to an entirely different ecosystem would be costly and time-consuming. Similarly, banks and financial services providers create high switching costs. Most customers hesitate to move their accounts, credit cards, or loans to another bank due to the hassle involved, giving financial institutions a natural moat. Companies with high switching costs enjoy long-term customer retention, allowing them to charge premium prices and increase their profitability over time.

D. Network Effect Moat: More Users, More Value

A network effect occurs when a business becomes more valuable as more people use it, making it extremely difficult for competitors to catch up. Visa, for example, dominates the global electronic payments industry, benefiting from a vast network of merchants and cardholders that make it the preferred choice for transactions. Similarly, Google’s search engine has an enormous network effect—more users mean more data, which leads to better search results, attracting even more users. This cycle creates a powerful moat that prevents competitors from gaining traction. Companies with strong network effects often turn into monopolies, as competitors struggle to match their scale, efficiency, and widespread adoption.

E. Regulatory Moat: Protection Through Government Barriers

Some companies benefit from government regulations that make it difficult for new competitors to enter the market. In the banking industry, for instance, securing a license is a long and complicated process, which gives an advantage to established players like HDFC Bank and SBI. Similarly, ITC, one of India’s largest cigarette manufacturers, benefits from strict tobacco advertising regulations, which make it difficult for new brands to enter the market and challenge its dominance. Another example is Nestlé, which enjoys a regulatory moat in the infant nutrition industry due to government restrictions on marketing infant formula. Regulatory moats create stable profit streams and long-term protection for companies, as new entrants face significant hurdles in establishing themselves.

F. Intellectual Property (IP) Moat: The Power of Innovation

Companies that own patents, copyrights, or trademarks have an intellectual property moat, as these legal protections prevent competitors from copying their innovations. In the pharmaceutical industry, Pfizer and Eli Lilly hold drug patents that give them exclusive rights to manufacture and sell their medicines, ensuring high profits for years before the patents expire. In the technology sector, Apple has built a formidable IP moat by integrating proprietary hardware and software, creating an ecosystem that is difficult for competitors to replicate. Businesses with strong IP moats enjoy long-term pricing power and sustained profitability, as their unique products or technologies provide a distinct competitive edge.

Measuring and Tracking Economic Moats

To assess whether a company’s economic moat is strengthening or weakening, investors should track key financial metrics. Return on Capital Employed (RoCE) is a crucial indicator—companies with strong moats consistently generate high RoCE, reflecting efficient capital usage and sustainable profitability.

Profit margins also play a significant role. Businesses with durable competitive advantages tend to maintain high and stable profit margins, signaling strong pricing power. A decline in margins may suggest rising competition or operational inefficiencies.

Another important metric is market share trends. A growing market share indicates a strengthening moat, while a declining one may signal competitive threats or industry shifts.

Finally, customer retention rates provide insights into brand strength, switching costs, and network effects. High retention rates suggest a loyal customer base, reinforcing a company’s moat and ensuring long-term revenue stability.

By monitoring these metrics, investors can better understand a company’s competitive position and make informed investment decisions.

Why Economic Moats Matter for Investors

Companies with strong economic moats have the ability to grow earnings consistently, maintain a dominant market position, and deliver superior returns to long-term investors. Their competitive advantages shield them from industry threats, allowing them to sustain profitability even in challenging times.

A great example is Bajaj Finance, which built a strong moat in financial services by being a first mover in consumer lending. Its strong brand and customer trust helped it maintain dominance for years. However, as more players entered the market, its competitive edge started to shrink, leading to slower growth.

Similarly, DMart has established a formidable moat in the retail sector through cost leadership, efficient inventory management, and bulk purchasing. Despite growing competition from online grocery platforms, DMart continues to thrive because of its unique business model, proving how a strong moat can protect long-term profitability.

Conclusion: Why Moats Are the Key to Wealth Creation

The secret to long-term investing success is identifying companies with strong, durable moats. These businesses can weather economic downturns, fend off competition, and grow steadily over decades.

Key Takeaways:

– Moats protect profits and market share.

– Companies with strong moats generate higher investor returns.

– Smart investors focus on widening moats, not just short-term profits.

Before investing, always ask: Does this company have an economic moat? If yes, is it widening or shrinking? By mastering the concept of economic moats, you’ll build a stronger investment portfolio and make smarter decisions—just like the world’s best investors!