Written By: Mridul Mishra

In the competitive world of business, companies often find themselves under immense pressure to meet financial expectations. While the desire to deliver strong financial results is natural, some companies may resort to unethical practices to inflate their profits and present a rosier picture of their financial health. While potentially offering short-term benefits, this behaviour can have severe long-term consequences. Understanding how companies manipulate their financials, recognizing the red flags, and learning from past corporate frauds is essential for fostering ethical practices and sustainable business growth.

Understanding the Modus Operandi of such frauds (with case studies)

Companies have various ways to artificially inflate their profits, manipulating financial data to appear more profitable than they actually are. These methods often involve manipulating accounting practices, hiding liabilities, or exaggerating revenue figures to mislead stakeholders about the true financial condition of the company. Following is some of the common methods utilized to achieve this goal:

1) Capitalizing expenses is a typical method used by management where instead of recording expenses as costs in the current period they record them as assets on the balance sheet. In accounting, companies typically incur expenses to generate future revenues, which should be accounted for in the period in which they are incurred. However, some companies capitalize on expenses, turning them into assets, and only recognize them as expenses over time. This lowers expenses in the current period and increases the profits.

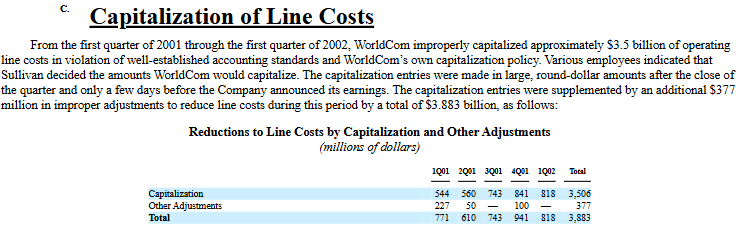

Case Study (Expense Capitalization): WorldCom

WorldCom was a telecommunications company that in 2002 admitted to overstating its assets by over $11 billion. The company had manipulated its financials by capitalizing operating expenses and reporting fictitious revenue. The fraud led to WorldCom’s bankruptcy, and CEO Bernard Ebbers was sentenced to 25 years in prison for his role in the scandal. The company’s downfall had far-reaching effects, shaking investor confidence and leading to stricter regulations in the telecom industry.

The indication of such scams is usually hidden in footnotes that explain the bifurcation in capitalizations and additions to the new assets that appear on the balance sheet (likely under other assets). The result of this capitalization translates to an artificial boosting of the top line in the current year even though all the benefits of the expenditure will be utilized in the same year the capitalized expense persists on the balance sheet for multiple years before getting written off by way of depreciation.

For WorldCom regulators discovered the pattern that the company had suddenly moved multiple operating line items out of the profit and loss and had started reporting then on the balance sheet as assets instead.

Source: SEC Report of Investigation

There are several categories of expenses that are the most likely candidates for improper capitalization, including the following:

1. Start-up costs

2. Research and development costs

3. Repairs and maintenance (capitalized as property and equipment)

4. Software development and acquisition

5. Websites

6. Development of intangible assets

7. Advertising

8. Other deferrals and prepaid expenses

2) Off-balance-sheet financing is another technique used by companies to hide liabilities from their balance sheets. By using special-purpose entities or structured finance deals, companies can shift debt and obligations off their balance sheets, making them appear less leveraged and more financially stable than they truly are. This method is particularly effective in hiding risk and liabilities from investors, creditors, and auditors. This also allows them to keep the interest expense out of the income statement and buffer the profits.

Case Study (Off-balance-sheet financing): Enron Corporation

Enron was once one of the largest energy companies in the world, but in 2001, it was revealed that the company had used off-balance-sheet entities to hide debt and inflate profits. The fraud led to the company’s bankruptcy, and top executives, including CEO Jeffrey Skilling and CFO Andrew Fastow, were convicted of fraud and conspiracy. Enron’s collapse wiped out billions of dollars in shareholder value and led to significant regulatory changes, including the Sarbanes-Oxley Act of 2002, aimed at increasing corporate transparency.

Enron’s heavy reliance on debt only made its financial struggles worse. To really understand just how much debt Enron was carrying before it went bankrupt, here is a look at Enron’s liabilities and shareholders’ equity from its 2000 year-end balance sheet.

Source: Enron 2000 Annual Report, page 33

Enron’s shareholders’ equity stood at $11.5 billion, while the total liabilities and equity combined were $65.5 billion. Subtracting the equity from the total gives us liabilities of $54 billion.

Doing a bit more math, we find that Enron’s debt-to-equity ratio was 4.7x

To put this in perspective, here’s how Enron’s debt-to-equity ratio stacks up against the ratios of the world’s biggest oil and gas companies:

- Exxon Mobil: 0.25x

- Chevron: 0.31x

- ENI SpA: 0.51x

- Total: 0.54x

- Royal Dutch Shell: 0.48x

- BP: 0.63x

It’s clear that Enron’s leverage of 4.7x far outstripped the current debt levels of these major oil companies, even in today’s challenging market conditions.

A quick peer comparison along with curious reading of the related party transactions would have unfolded the fraud that the company eventually committed to remove the high debt-levels from its balance sheet.

Enron’s top executives were motivated to avoid showing any losses or dips in earnings whenever they could.

To make this happen, Enron would shift liabilities to separate, off-the-books entities. These entities would take the hit of extremely high interest expense and take on the burden of paying the debt back (on paper), keeping Enron’s own financial statements looking better. The fact that Enron itself wasn’t reporting these liabilities didn’t mean they didn’t exist. Essentially, they reported a healthy balance sheet, leaving out the negative side of the equation.

3) Channel stuffing involves sending more products to distributors or retailers than they can actually sell. This tactic is often used at the end of a fiscal period to inflate sales figures, even though the products are not yet sold to end consumers. By shipping excess inventory, companies can record higher sales numbers and boost profits, but it comes at the cost of long-term sustainability, as the unsold products will eventually have to be returned or sold at a loss.

Case Study (Channel stuffing): Mamaearth

It is clear from beside picture, given the timing of the sales activity the promoters had significant incentive of indulging in channel stuffing as the company was at the verge of an IPO.

This can easily be identified by looking at the inventory revaluation losses or rapid fluctuation in sales. For the year in which channel stuffing has been done investors can see a boost in sales and profits without significant growth in quality of earnings (most of them are done on much more lenient terms than regular credit sales. In the subsequent years the sellers will refuse to accept new inventory and will likely return a major chunk of the lot they received earlier causing the company to report a loss or reduced revenues in the upcoming quarters.

In case of Mamaearth (Honasa Consumer Ltd) the market quickly responded to the observation and the company’s stock was in a downward rally for a week in the market after the news broke. The stock lost 22.85% from November 28, 2023 to December 05, 2023. In July of 2024 the company was accused of yet again burdening its distributers with excess stock.

Red Flags Indicating Potential Profit Inflation

Recognizing the signs of financial manipulation is essential for anyone involved in monitoring corporate finances, whether it’s investors, auditors, or regulatory bodies. There are several key indicators that might suggest a company is engaging in fraudulent or unethical practices to inflate profits.

One major red flag is inconsistent cash flows. Companies that report strong earnings but have cash flow problems are worth investigating.

Cash flow is a more reliable indicator of financial health than net income, and if a company’s reported earnings don’t align with its cash flow from operations, it could indicate that profits are being inflated through accounting tricks like premature revenue recognition or deferred expenses.

Another warning sign is unusual revenue growth. If a company’s revenue is growing rapidly without a clear strategic reason or without an accompanying increase in market share, it might be manipulating its financials. Companies in the same industry often follow similar growth patterns, so a company that outperforms its competitors without explanation could be using manipulative techniques to boost its top line.

Frequent changes in accounting policies should also raise concerns. Companies that frequently alter their accounting methods, particularly when it comes to revenue recognition or expense capitalization, might be doing so to manipulate their financial results. These changes could indicate a desire to manage earnings or hide financial problems from investors.

Complex or opaque financial structures are another potential red flag. If a company’s financial statements are difficult to understand or contain a significant number of off-balance-sheet transactions or special-purpose entities, it could be trying to hide liabilities or artificially inflate its earnings. Transparency is key in financial reporting, and companies that make it difficult to understand their financial position may be hiding something.

Lastly, high inventory levels can suggest that a company is inflating its financial position. If inventory is growing faster than sales, it could be an indication that the company is overestimating the value of its assets or delaying the recognition of expenses. It’s important to scrutinize the company’s inventory practices, especially if there are no clear explanations for significant increases.

Motivations Behind Inflating Profits

There are several reasons why companies or their management may resort to inflating profits. Often, the motivations are tied to the desire to present a stronger financial position to attract investment, secure loans, or maintain stock prices.

Meeting market expectations is one of the most common motivations behind profit inflation. Companies, particularly those publicly traded, face intense pressure from analysts, investors, and shareholders to meet or exceed quarterly earnings expectations. If a company is struggling to meet these targets, management may be tempted to manipulate the numbers to present a more favourable picture and avoid disappointing investors.

Another key motivation is securing financing. Companies may artificially inflate profits to make themselves appear more financially stable and attractive to potential investors or lenders. By presenting strong earnings, they can obtain better terms for loans or attract additional investment, which can then be used to fund operations or expansion.

Additionally, Performance-based compensation may be another driving factor behind profit manipulation. Many executives and managers have compensation packages tied to specific financial metrics, such as earnings per share (EPS) or revenue growth. If these targets are too ambitious, management may engage in unethical practices to meet them, even if it means misleading stakeholders or compromising the integrity of the company’s financial reporting.

Lastly, maintaining stock prices can drive management to inflate profits. A strong stock price is often seen as an indicator of a company’s success, and it benefits not only the company but also its management team, especially, as stated earlier, if their compensation is tied to stock options or share prices. In this environment, some companies may resort to inflating profits to maintain the value of their stock and preserve the perception of financial health.

Other notable Examples of Corporate Frauds

Several corporate scandals have exposed the consequences of inflating profits and manipulating financial data. Perhaps the most infamous of these is the case of

More recently, Kangmei Pharmaceutical, a Chinese company, was caught inflating its financials by overstating its cash holdings by $4.3 billion. The fraud was uncovered in 2019, and the company was forced to pay hefty fines and face severe regulatory scrutiny. These examples highlight the significant risks and consequences associated with inflating profits and manipulating financial data.

On the domestic front the Satyam scandal, often referred to as “India’s Enron,” involved the company’s founder, Ramalinga Raju, who manipulated profits by inflating the company’s financial statements. Raju confessed to overstating the company’s profits and assets by over $1 billion. Satyam had falsely reported inflated revenues and profits for several years, misrepresenting its actual financial position to investors and auditors. The fraud led to the company’s collapse and severe legal consequences for Raju and other top executives. Satyam was eventually acquired by Tech Mahindra in a government-mandated bid.

Similarly, Kingfisher Airlines, founded by businessman Vijay Mallya, is a prominent example of profit manipulation in India’s aviation sector. The company allegedly inflated its profits and misused funds, leading to financial misreporting. Kingfisher was reported to have hidden the scale of its losses and manipulated its balance sheets to give a false impression of profitability. Eventually, the airline went bankrupt, and Mallya faced numerous charges for financial mismanagement and embezzlement, leading to his fugitive status in India.

The list continues and many notable companies such as Reliance Communications (2006), Nestle India (2015), IndiaBulls Real Estate (2018) have been accused of indulging in such practices in the past.

Consequences for Companies and Individuals Involved

The consequences of inflating profits can be devastating. Legal penalties often include hefty fines for the company and long prison sentences for individuals involved in the fraud. For example, in the case of WorldCom, CEO Bernard Ebbers was sentenced to 25 years in prison, and the company was forced to pay billions in fines and settlements.

Reputational damage is another major consequence. Companies found guilty of financial fraud often suffer a loss of customer trust, which can lead to decreased sales, difficulty in retaining employees, and diminished brand value. The damage to a company’s reputation can be irreparable, as customers and investors may choose to distance themselves from a business that has been involved in fraud.

Financially, companies face stock price declines, lawsuits, and the loss of investor confidence. The financial burden of penalties, legal fees, and fines can cripple a company’s ability to operate effectively, potentially leading to bankruptcy or liquidation.

In the face of these risks, maintaining ethical standards is crucial for any organization. Ethical business practices ensure transparency, build trust, and provide a solid foundation for long-term success. Companies that embrace ethics create a positive work environment, encourage innovation, and cultivate loyalty among customers and employees alike.

The Importance of Ethical Practices and Responding to Misconduct

If an individual comes across evidence of corporate misconduct, it is vital to respond appropriately. Reporting such behaviour to internal whistleblower channels, regulatory bodies, or the authorities is crucial. Many organizations provide confidential reporting mechanisms to protect whistleblowers from retaliation, ensuring that those who report unethical behaviour are safeguarded.

Long-Term Benefits of Ethical Business Practices

In the long term, adhering to ethical practices leads to more sustainable earnings and profitability. Ethical companies enjoy better relationships with investors, customers, and employees, all of whom value transparency and honesty. By prioritizing ethical behaviour, companies build strong foundations that foster growth, innovation, and resilience in times of economic uncertainty.

Investors are increasingly recognizing the importance of ethical business practices when making investment decisions. Companies with strong ethical standards are better positioned to navigate market challenges, mitigate risks, and create long-term value. Furthermore, ethical businesses are more likely to attract top talent and retain loyal customers, both of which are crucial for long-term success.

In conclusion, while the temptation to inflate profits may arise from various pressures, the long-term benefits of ethical business practices far outweigh the short-term gains of financial manipulation. Companies that prioritize integrity not only comply with legal standards but also build a foundation for enduring success and trust in the marketplace.