Written By: Nikhil Thapliyal

Imagine investing in a company that appears to be financially sound, only to discover hidden obligations that can completely alter its financial landscape. This is not just a hypothetical scenario but a reality that has shocked investors and stakeholders in cases such as the infamous Enron scandal.

At the heart of these revelations lies the concept of off-balance-sheet items and their profound influence on a business’s solvency ratio. Understanding these hidden financial obligations is crucial for investors and analysts aiming to determine the true financial health of an organization and make a sound financial decision.

What Are Off-Balance-Sheet Items?

Off-balance-sheet items refer to financial obligations or assets that a company excludes from its financial statements. Understanding these items is essential because they reveal potential financial obligations that might not be immediately apparent. This knowledge helps investors and stakeholders anticipate risks, evaluate a company’s true financial standing, and make informed decisions to avoid unforeseen financial impacts.

Off-Balance-Sheet Liabilities

These liabilities are prospective financial obligations that do not immediately qualify to be included in the main financial statements. However, should these obligations materialize, they could adversely affect a company’s financial position, jeopardizing investor and stakeholder interests.

Some of the most common types of Off-Balance-Sheet Liabilities include:

– Operating Leases

An operating lease allows a company to use an asset (e.g., office space, vehicles, or equipment) without owning it. Historically, these leases were not recorded on the balance sheet but were disclosed in footnotes, despite representing long-term financial commitments. This makes Companies appeared less leveraged, thereby enhancing metrics like debt-to-equity ratios.

– Special Purpose Entities (SPEs)

SPEs are separate legal entities created to isolate financial risks or manage specific projects. They are used to hold assets or liabilities, keeping them off the parent company’s balance sheet. SPEs can shield the parent company from financial risk by assuming the hidden liabilities, distorting the company’s true financial picture.

– Contingent Liabilities

These are potential obligations dependent on future events, such as lawsuits, guarantees, or warranty obligations. They are disclosed in financial statement footnotes but not recorded on the balance sheet unless the likelihood of the obligation is high and can be reasonably estimated. Contingent liabilities can potentially become significant obligations, affecting solvency. Investors must analyze disclosures carefully to assess risks.

– Derivative contracts

Derivatives contracts such as options and swaps, are agreements whose value is derived from underlying assets or indices. While these contracts may not appear on the balance sheet initially, they can represent significant potential liabilities if market conditions change unfavorably. For instance, a company may enter a derivative contract to hedge against currency fluctuations or interest rate changes; however, if the market moves against the company’s position, it could face substantial cash outflows that impact its solvency.

– Securitization of Assets

Securitization involves bundling financial assets, like loans or receivables, and selling them to investors. While the items are removed from the balance sheet, the company may retain some risk through guarantees or servicing agreements. Securitization allows companies to offload liabilities but retain risks that may not be fully disclosed, misleading stakeholders. For example, during the 2008 financial crisis, mortgage bonds were bundled and sold as securities, effectively shifting them off the originating banks’ balance sheets. This practice concealed the true level of risk, as the retained exposure to defaults was not transparent, contributing to the systemic collapse when the housing market crashed.

– Guarantees and Letters of Credit

A guarantee is a promise to fulfill a financial obligation if another party defaults. Letters of credit ensure payment to a seller in case of buyer default. These commitments remain undisclosed as liabilities unless triggered, potentially leading to large, unforeseen financial obligations.

How does Off-Balance Sheet Liabilities affect Solvency Ratios?

When off-balance sheet (OBS) liabilities are excluded from financial statements, the company’s reported solvency ratios often appear healthier than they truly are. This misrepresentation can conceal significant risks associated with the company’s financial health, potentially leading to poor investment decisions, higher borrowing costs, and weakened stakeholder confidence.

Out of balance sheet liabilities Impact on Solvency Perception:

– Misleading Financial Ratios: Off-balance-sheet (OBS) liabilities, like operating leases or contingent liabilities, can make solvency ratios look better than they actually are. For example, debt-to-equity or debt-to-assets ratios may show lower leverage, giving a false sense of financial stability.

– Hidden Financial Risks: Excluding OBS liabilities hides significant risks. If these obligations materialize, they can cause financial strain, hurt credit ratings, and increase borrowing costs, damaging the company’s solvency.

– Investor Trust: Investors rely on solvency ratios to evaluate a company’s ability to handle debt. Undisclosed OBS liabilities, when revealed, can shock investors, as what happened in the Enron case, leading to stock price drops and loss of trust.

– Unfair Comparisons: Companies hiding OBS liabilities may seem healthier than fully transparent peers, misleading investors and creating unfair advantages. Given below are the example highlighting the implications of OBS liabilities on solvency ratios

Given below are the examples illustrating the effect of out of balance sheet liabilities upon the various solvency ratios:

Example 1: Debt-to-Equity (D/E) Ratio Impact

The D/E ratio compares the total debt a company owes to the equity held by shareholders. It reflects how much of the company’s operations are financed through debt versus equity.

- Example: A company reports ₹1 crore in total debt and ₹2 crore in equity, giving it a Debt-to-Equity (D/E) ratio of: 0.5. Now, suppose the company has ₹50 lakh in off-balance sheet obligations (e.g., operating leases or guarantees). If these are included in the calculation, the total debt rises to ₹1.5 crore, resulting in a revised D/E ratio of: 0.75

- Implications: The new ratio shows higher leverage, changing how stakeholders view the company’s risk. They’ll see the company as more dependent on debt, which could raise concerns about its ability to handle downturns. Investors may demand higher returns or reduce their investment, while creditors might impose stricter loan terms or higher interest rates to offset the increased risk.

Example 2: Debt-to-Assets Ratio Impact

The Debt-to-Assets ratio compares a company’s total debt to its total assets. It indicates what proportion of the company’s assets are financed by debt.

- Example: A company reports ₹1.5 crore in total assets and ₹1 crore in total debt, resulting in a Debt-to-Assets ratio of: 0.67. However, upon including ₹75 lakh as Out of balance sheet liabilities, such as debt guarantees or undisclosed contingent liabilities, the total debt increases to ₹1.75 crore. This revises the Debt-to-Assets ratio to: 1.17

- Implications: A ratio above 1 means the company’s liabilities are greater than its assets, signaling potential insolvency. This can shake stakeholder confidence, as the company may struggle to repay debts without selling assets or securing extra funding. Creditors may deny credit, raise interest rates, or demand faster repayment, while investors could lower the stock value due to the higher financial risk.

Example 3: Interest Coverage Ratio (ICR) Impact

The ICR measures a company’s ability to pay its interest obligations from its operating income. It indicates how comfortably the company can handle interest payments without affecting its capital.

- Example: A company reports ₹20,00,000 in EBIT and ₹4,00,000 in annual interest expense, resulting in an Interest Coverage Ratio (ICR) of: 5. Suppose the company has ₹6,00,000 in annual lease payments associated with off-balance sheet liabilities. These payments reduce the EBIT to ₹14,00,000, revising the ICR to: 3.5

- Implications: A lower Interest coverage ratio means the company struggles more to cover interest expenses, signaling higher financial stress. This can hurt its credit rating, making it harder and more expensive to raise debt. Creditors may add more restrictions, while investors could view the company as financially weaker.

Conclusion:

The inclusion of off-balance sheet liabilities in solvency analysis provides a clearer picture of a company’s financial health. While these obligations may not appear directly on the balance sheet, their impact on solvency ratios and can reveal hidden financial risks. Off-balance sheet (OBS) liabilities, while not explicitly recorded on the balance sheet, significantly impact a company’s perceived solvency. These hidden obligations, such as operating leases, derivative contracts, and loan commitments, can obscure the true extent of a company’s debt burden and increase its financial risk. This lack of transparency can lead to lower credit ratings, higher borrowing costs, and erode investor confidence. Consequently, investors and creditors must carefully consider these off-balance sheet items when assessing a company’s financial health and making informed investment or lending decisions. Stakeholders must critically evaluate these liabilities to avoid underestimating the company’s financial vulnerabilities and make informed decisions about investments, loans, and partnerships.

The General Electric (GE) controversy

The General Electric (GE) controversy is a notable case where off-balance-sheet liabilities raised concerns about corporate transparency. GE used operating leases and financial guarantees to keep billions of dollars in liabilities off its balance sheet, creating the illusion of a healthier financial position. Before 2019, operating leases were only mentioned in the notes of financial statements, and financial guarantees from GE Capital were recorded as contingent liabilities, which were not reported unless they became actual obligations. These methods misled stakeholders and hid the full extent of GE’s financial obligations.

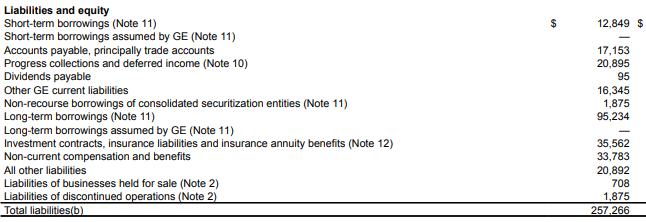

Source: General Electric AGR 2018 (page no. 106)

Source: General Electric AGR 2018 (page no. 85)

General Electric’s use of off-balance-sheet liabilities, particularly for operating lease obligations, allowed the company to exclude significant financial commitments from its balance sheet. For example, in FY 2018, GE had $5.55 billion in operating lease obligations, which were disclosed only in the notes of its financial statements. By keeping these liabilities off the balance sheet, GE portrayed a more favorable financial position by understating its leverage and total liabilities.

It was until 2019, that the new accounting rules under ASC 842 required GE to include operating lease liabilities on its balance sheet. This change revealed nearly $3.16 billion in lease obligations for 2019 alone, showing that GE’s financial position was more strained than previously thought. While financial guarantees were disclosed, their complexity and risks remained a concern.

Although these practices followed earlier accounting rules, they raised questions about GE’s transparency and ethics. The changes brought regulatory scrutiny and shook investor confidence in the company’s stability.

Regulatory Changes aimed at addressing Off-Balance-Sheet Liabilities

Following the scandals such as Enron’s, investor trust was damaged by the widespread use of off-balance-sheet liabilities to falsify financial statements, which also highlighted the need for stronger laws to improve accountability and transparency. Below mentioned are the key regulatory changes aimed towards addressing these issues:

Sarbanes-Oxley Act (SOX) of 2002

The Sarbanes-Oxley Act (SOX) of 2002 was passed to address corporate scandals that revealed severe issues in financial reporting and governance. It introduced several important changes to improve transparency and accountability in companies’ financial practices.

– Improved Financial Transparency: SOX requires companies to provide complete and accurate financial reports. This includes the disclosure of off-balance-sheet arrangements, which were often used to hide liabilities. By enforcing such transparency, the Act prevents companies from concealing financial obligations.

– Stronger Internal Controls: Under Section 404 of SOX, companies must set up strong internal controls to monitor financial reporting. These controls must be regularly evaluated for effectiveness, with external auditors reviewing and validating them. This ensures that financial processes are reliable and reduces the chances of misstatements.

– Executive Accountability: The Act holds CEOs and CFOs personally responsible for the accuracy of financial statements. They must certify the reports themselves, making them directly liable for any errors or misrepresentation. This significantly increases accountability at the highest level of management.

Further, the International Financial Reporting Standards (IFRS) also introduced new rules, especially through IFRS16, to improve the way companies disclose liabilities. Under this standard, businesses must include lease liabilities directly on their balance sheets, addressing a common issue where such liabilities were previously kept off the books thereby promoting greater transparency by requiring companies to disclose contingent liabilities and guarantees clearly.