NSE: BANKBARODA

Market Performance Indicators

Commentary

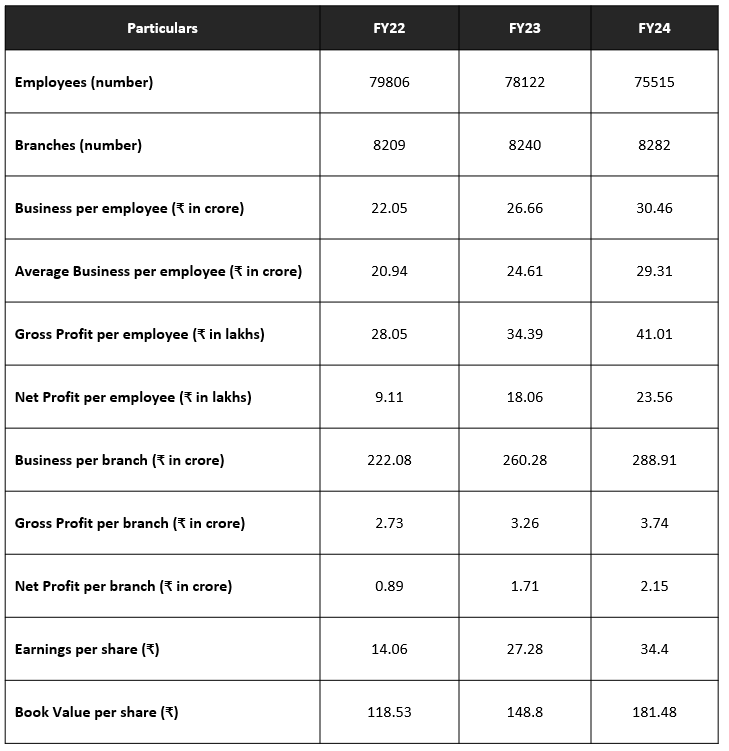

Bank of Baroda’s financial performance has demonstrated strong trends across key metrics. Interest Income grew 17% in FY22 and FY23 due to loan growth and a focus on higher-yielding assets. Still, growth moderated in FY24 as loan growth slowed and the bank adopted a more balanced strategy. Interest Expense increased moderately in FY22, rose sharply in FY23 due to rising deposit rates, and surged further in FY24 as deposit costs continued to climb. NIM improved in FY22 and FY23 due to effective asset-liability management but contracted in FY24 due to the higher cost of deposits.

NII grew in FY22 and FY23 driven by strong loan growth and margin expansion, but the growth moderated in FY24 due to slower loan growth and NIM contraction. Operating Expenses rose 2.8% in FY23 and FY24, driven by increased costs and a wage settlement in FY24. Despite higher expenses, the Cost to Income Ratio improved in FY22 and FY23 and remained stable in FY24. Net Profit grew 77% in FY22 and FY23, reaching a record high in FY24, supported by strong other income and controlled credit costs despite NIM contraction. ROA improved in FY22 and FY23 and remained high in FY24 due to record profits.

Yield on Advances improved consistently due to a shift towards higher-yielding assets and repricing of loans, while the Cost of Deposits remained stable in FY22, increased in FY23, and escalated further in FY24 as market deposit rates rose. The Capital Adequacy Ratio remained strong throughout, supported by prudent capital management and successful capital raising. Overall, BoB’s performance reflects growth in income and efficiency, though rising deposit costs and operating expenses in FY24 moderated some of these gains.