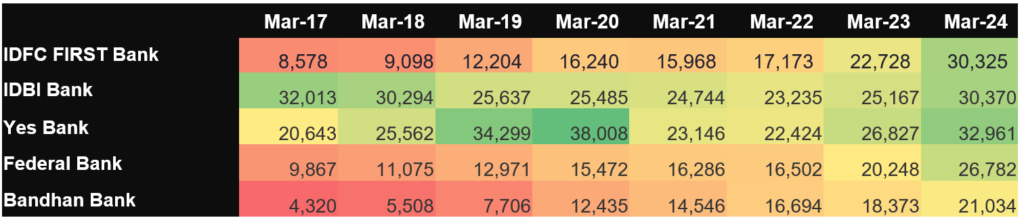

Revenue (in cr)

• IDFC FIRST Bank, Federal Bank with CAGR (5Y): 15%, and Bandhan Bank with CAGR (5Y): 23% stand out as better performers due to their consistent and significant revenue growth. Also, IDFC FIRST Bank shows notable jumps in revenue, particularly from Mar-19 to Mar-20 and Mar-23 to Mar-24 with a sales growth CAGR (5Y): 20%

• IDBI Bank with CAGR (5Y): 4% is at a moderate level, showing signs of recovery and stabilization.

• Yes Bank with CAGR (5Y): -1% is at the lowest level due to its revenue volatility and instability, despite recent improvements..

EPS

• Federal Bank has consistently shown positive EPS growth over the years (5.03 in Mar-17 to 14.95 in Mar-23). This indicates strong and stable profitability.

• IDFC FIRST Bank would be classified at a moderate level. Despite experiencing negative EPS in some years, it has shown recovery and positive growth in recent years, indicating a stabilizing financial performance. Also, Bandhan Bank and Yes Bank are at the same level.

• IDBI Bank consistently had the lowest EPS performance among the banks listed, with significant negative EPS in earlier years and only modest recovery in recent years.

Net Interest Margin

• IDFC FIRST Bank and Bandhan Bank stand out as better performers due to their significant improvement and high NIM, respectively.

• IDBI Bank and Federal Bank are at a moderate level, showing steady and stable performance.

• Yes Bank is at the lowest level due to its fluctuations and instability in maintaining a consistent NIM.

Credit Deposit Ratio

• IDFC FIRST Bank started with a high CD ratio of 123 in Mar-17, peaking at 132 in Mar-20, and then declining to 105 in Mar-23.The high initial ratio indicates higher credit risk, and the declining trend suggests efforts to improve liquidity and manage risk.

• Federal Bank stands out as the better-performing bank with a stable and consistent CD ratio, indicating effective management of liquidity and credit risk. Bandhan Bank and Yes Bank are at a moderate level due to their aggressive growth and subsequent stabilization efforts.

• IDBI Bank’s consistently low CD ratio places it at the lowest level, indicating it may be too conservative or facing difficulties in expanding its lending activities.