Research By: Tushar Khurana

An important development in India’s infrastructure finance scene is the introduction of Infrastructure Investment Trusts or InVITs. InVITs, based on the widely popular REIT (Real Estate Investment Trust) structure, give institutional and individual investors a way to engage in infrastructure projects and pool their resources, contributing to the sector’s expansion. This article explores the fundamentals of InVITs, including their advantages, types, structure, and effects on investors and the overall economy.

Infrastructure assets that generate revenue can be purchased by people and institutions through collective investment vehicles, or InVITs. These are overseen by the Securities and Exchange Board of India (SEBI) and usually involve large-scale projects like power transmission, renewable energy, and highway construction. InVITs provide returns to investors through dividends or interest income by pooling resources to help fund, run, and maintain these assets.

Types of InvITs

People can invest in infrastructure projects through InvITs in two different ways: directly or through special purpose vehicles, dividing the projects into two categories.

Investment in Completed Projects that Generate Revenue: This category permits investment in completed projects that generate revenue and typically attracts investors through a public offering.

Investment in ongoing projects: In this category, investors are permitted to invest in ongoing or completed projects. This type, notably, chooses to arrange its units privately.

Structure of InvITs

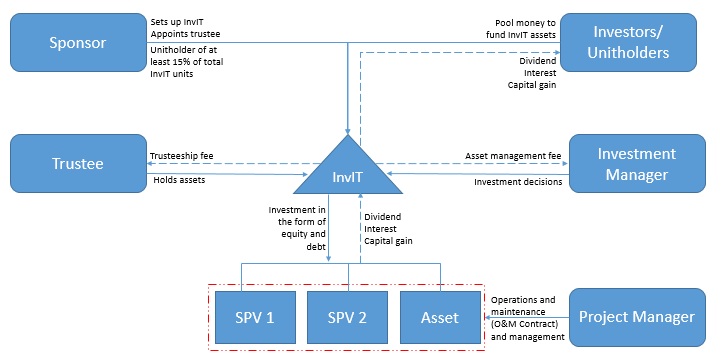

InVITs have a structure related to mutual funds, with important players including an investment manager, project manager, sponsor, and trustee:

- Sponsor: The organization that creates the InVIT and provides the initial funding. A promoter, body corporate, limited liability partnership, or business with a minimum net worth of Rs. 100 crore is considered a sponsor. In addition, companies have to retain a minimum of 15% of all InviTs for a minimum of three years, or until they are advised of any regulatory need. Regarding public-private partnerships or PPP projects, sponsors function as a Special Purpose Vehicle (SPV) in the partnership.

- Trustee: An impartial third party that monitors the InVIT’s activities to safeguard investors’ interests is typically a financial institution. As debenture trustees, they must be registered with SEBI. They must also allocate at least 80% of their funds to infrastructural assets that produce consistent income. Investment Manager: In charge of managing InVIT’s assets on a daily basis, including payouts and investment choices.

- Project Manager: Oversees the real infrastructure assets, making sure they run smoothly and produce the desired results. InVITs can be listed on a public exchange or privately. While privately placed InVITs are only accessible to high-net-worth individuals and institutional investors, publicly listed InVITs are traded on stock exchanges and offer liquidity to investors.

Purpose Of InVits

The main goal of InVITs is to help infrastructure companies quickly and effectively pay off their debts. Since infrastructure projects usually take a long time to start making good money, InVITs are useful for covering loan interest payments and other expenses in the meantime.

Advantages of InVITs

- Access to Stable, Long-Term Returns: InVITs provide investors with a long-term stream of income by funding operational infrastructure projects that produce consistent cash flows.

- Diversity: InVITs offer diversity by investing in a portfolio of infrastructure assets, which lowers the risk attached to any one project.

- Liquidity: The capacity to trade on stock exchanges provides liquidity for publicly listed InVITs, increasing their accessibility to a wider spectrum of investors.

- Tax Efficiency: Interest and dividend income streams are among the many tax-exempt or favorably taxed income streams that are part of an investment vehicle that is constructed to be tax efficient.

- Professional Management: By involving seasoned project and investment managers, it is ensured that infrastructure assets are managed effectively, and profits are maximized.

Threats Linked to InVITs

InVITs have several benefits, but there are also concerns involved.

- Market Risks: The value and returns to investors of InVITs are sensitive to market fluctuations, just like any other investment sold on public exchanges.

- Regulatory Risks: Modifications to tax laws, rules, or policies of the government may affect how well InVITs perform and are perceived.

- Operational Risks: The underlying infrastructure assets’ performance is critical. Returns may be adversely affected by any operational problems, including delays, cost overruns, or technical malfunctions.

- Interest rate risks: Since InVITs frequently involve long-term fixed-income returns, fluctuations in interest rates may have an impact on their attractiveness in comparison to alternative investments.

Who can invest in InVITs?

InVITs, like stocks, are listed on exchanges through an IPO. However, to invest in an InVIT IPO, you need a minimum of Rs. 10 lakhs, which might be challenging for smaller investors. On the other hand, high-net-worth individuals and institutions often find InVITs to be a good investment because of their potential for solid returns and the ability to invest in large-scale infrastructure projects.

How InvITs function in a real-world scenario

One of the most popular examples of an infrastructure investment trust in India is the IRB InvIT Fund. One of the first InvITs to be listed on the Indian stock exchanges, it was introduced in 2017.

Important points regarding the IRB InVIts Fund: –

- IRB Infrastructure Developers Ltd., a significant infrastructure development firm in India, is the trust’s sponsor.

- A portfolio of toll road projects around India is owned and managed by the InvIT. It has multiple active roadway projects as of 2024.

- The IRB InvIT Fund is established as a trust that manages and holds infrastructure properties, with toll collections serving as its main source of revenue.

- It is available for public trading on India’s Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

- Usually, every quarter, the InvIT distributes to unitholders a sizeable amount of its cash flows.

- By guidelines established by the Securities and Exchange Board of India (SEBI), it is managed by an investment manager and supervised by a trustee.

InVITs’ Significance in the Indian Economy

India’s aspirations for infrastructure development are greatly aided by InVITs. They assist in bridging the gap between the enormous amounts of capital needed for infrastructure projects and the scarce resources made accessible by conventional funding sources like government grants or bank loans. InVITs promote economic development by drawing private investment, particularly foreign capital, and aiding in the expansion of vital infrastructure.

Furthermore, InVITs support the government’s focus on monetizing current assets to finance new initiatives. Developers may recover value from operating assets by recycling capital through InVITs. This value can then be reinvested in new infrastructure projects, creating a positive feedback loop that promotes growth.

Current Innovations and Prospects for the Future

Since its founding, the InVITs market in India has grown significantly thanks to a few well-known launches and listings. Investor confidence has increased due to regulatory backing, which includes clear operational norms and favorable tax treatment. Furthermore, there appears to be a promising future for InVITs given the continued drive for infrastructure development, particularly in areas like urban infrastructure, roadways, and renewable energy.

In the future, the importance of InVITs is anticipated to grow as more investors pursue steady, long-term returns and as the government keeps highlighting infrastructure spending. Further growth in InVITs is expected due to innovations in their services and structure as well as improved investor awareness.

In Conclusion

In India, Infrastructure Investment Trusts are a revolutionary way to finance infrastructure. They offer a special chance for investors to gain steady, long-term returns while taking part in the development of the nation’s infrastructure. InVITs are positioned to become a pillar of infrastructure investment in India, assisting the country’s aspirational development objectives, as the market develops, and awareness rises.